Accounts Receivable

There are many ways that the USC Accounts Receivable Module helps you take control of your entire receivables process. One way is by giving you an organized means of managing customer information with many advanced reporting functions which, in turn, will allow you to make more accurate business decisions.

This Module is designed to assist with your invoicing, collecting, and tracking of receivables, and will also keep track of fees, charges, and expenses along with any other types of income or receivables.

Transactional Details

Retain transaction details for an entire fiscal year or for only the current period. Regardless of the option selected, account balances are maintained for the current and previous fiscal year.

Prior Period Adjustments

Access prior periods and make adjustments or even add new entries.

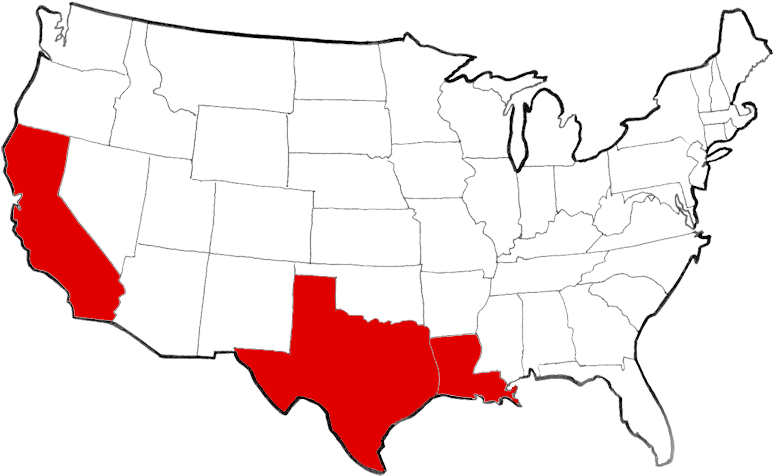

Unlimited Companies

Maintain separate accounting systems for an unlimited number of companies, each with their own independent chart of accounts, fiscal year ending date, etc.

Budget vs. Actual

Maintain a budget and produce Budget vs. Actual comparisons.

Departmentalization

Departmentalize the income statement including automatic postings to a consolidated company total department, while still being able to produce separated income statements.

Period Flexibility

Enter and retain transactions for new periods before closing out the current period.

FEATURES & BENEFITS

-

Track sales, costs and profit for each salesman, and calculate commissions due.

-

Track sales by type, allowing income sources to be analyzed within the General Ledger.

-

Post discounts, bad debts and other adjustments to the appropriate expense account within the General Ledger.

-

Automatically set the terms and calculate due dates and discount rates on each invoice.

-

Automate the processing of recurring invoices.

-

Produce customer lists including mailing labels.

-

Produce an aged analysis detailing outstanding invoices, categorizing them by number of days past due, and providing the phone number and contact information to assist in collections.

-

Calculate and report sales taxes collected and due.

-

Calculate and assess finance charges on past due amounts.

-

Calculate materials costs (when used in conjunction with the Inventory Control system).

-

Update the Accounts Receivable, General Ledger, and Inventory Control systems.

-

Generate a series of past-due letters requesting payment.