General Ledger

The USC General Ledger Module is the heart of our Accounting System. The flexibility and ease-of-use offered by this module will always allow you to have access to the precise and accurate information you need to make informed business decisions in a timely manner.

This Module is designed to assist you with tracking income and expense transactions and preparing comprehensive monthly ledger reports, financial statements and accompanying schedules all aimed at reflecting the current status of the business and assessing the profitability of the company.

Transactional Details

Retain transaction details for an entire fiscal year or for only the current period. Regardless of the option selected, account balances are maintained for the current and previous fiscal year.

Prior Period Adjustments

Access prior periods and make adjustments or even add new entries.

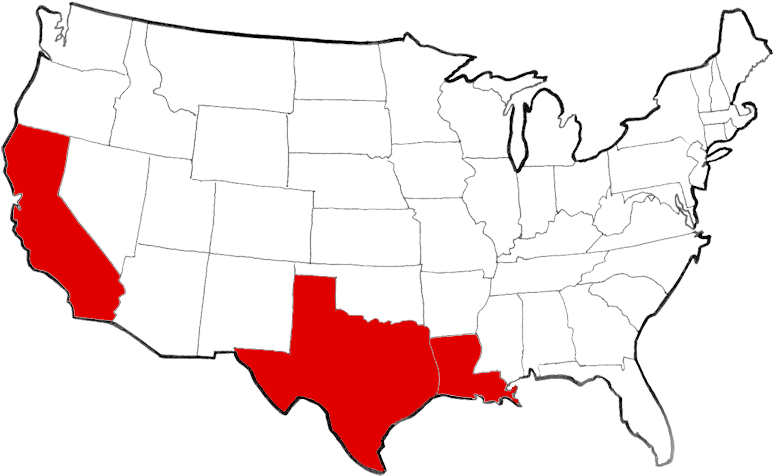

Unlimited Companies

Maintain separate accounting systems for an unlimited number of companies, each with their own independent chart of accounts, fiscal year ending date, etc.

Budget vs. Actual

Maintain a budget and produce Budget vs. Actual comparisons.

Departmentalization

Departmentalize the income statement including automatic postings to a consolidated company total department, while still being able to produce separated income statements.

Period Flexibility

Enter and retain transactions for new periods before closing out the current period.

FEATURES & BENEFITS

-

Customize and revise account numbers and add departments at any time during a fiscal year, facilitating the handling of simple or complex accounting environments in order to adjust for company growth.

-

Process accrual entries while automatically processing reversing entries for accruals in the next accounting period.

-

Retain and automatically process recurring entries in each accounting period.

-

Group accounts to be scheduled for printing separately on the financial statements.

-

Set allowable journal period limits for all applications to eliminate posting to the wrong accounting period.

-

Edit journal entries posted from other applications prior to updating account balances.

-

Create sub-accounts for more detailed transactions, and the ability to print separate ledger reports for all sub-accounts.

-

Automatic percentage allocation of amounts to multiple departments and accounts.

-

Design flexible financial statements, providing for easy changes to the appearance of the balance sheet and the income statement.

-

Export financial statements or ledger reports to a number of different formats outside of the accounting software, including (but not limited to) Microsoft Excel spreadsheets.