Job Cost

Make more accurate job estimates with the USC Job Cost Module by accurately keeping track of your project costs. A wide variety of reports are included in this Module to ensure your expenses are staying inside of budget, allowing each job to generate a profit for your company.

The Job Cost Module is designed to provide a method of tracking material costs, labor costs, and billings on multiple jobs as well as assist in developing a true picture of the profit/loss of an on-going job. This Module keeps track of estimated and actual hours, costs, and billings on the jobs by phase, category, and class, and can also automatically determine an estimated percentage of completion on each job.

Transactional Details

Retain transaction details for an entire fiscal year or for only the current period. Regardless of the option selected, account balances are maintained for the current and previous fiscal year.

Prior Period Adjustments

Access prior periods and make adjustments or even add new entries.

Unlimited Companies

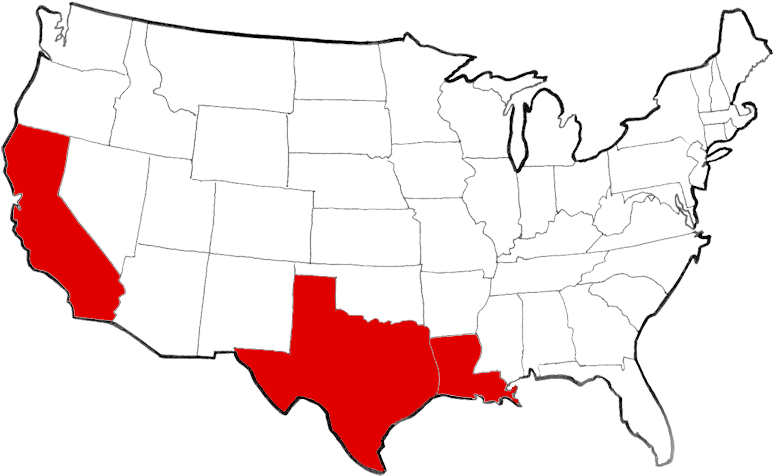

Maintain separate accounting systems for an unlimited number of companies, each with their own independent chart of accounts, fiscal year ending date, etc.

Budget vs. Actual

Maintain a budget and produce Budget vs. Actual comparisons.

Departmentalization

Departmentalize the income statement including automatic postings to a consolidated company total department, while still being able to produce separated income statements.

Period Flexibility

Enter and retain transactions for new periods before closing out the current period.

FEATURES & BENEFITS

-

Seamless integration with the Payroll, Accounts Receivable, Accounts Payable, and General Ledger systems.

-

Automatically post labor and material costs on each job from the Payroll and Accounts Payable to the Job Cost Module.

-

Automatically post billings from Job Cost into the Accounts Receivable Module.

-

Easily view automatically-posted General Ledger transactions associated with Payroll, Material Expenses, and Billing Revenue.

-

Sort and total transactions by class, category, phase, and job through the integrated Job Cost Detail report.

-

Produce an analysis of the comparison between the earnings-to-date and actual billings through utilization of a Job Cost Summary report.

-

Effortlessly view Gross Billed Amount, Earned-to-Date Amount, Direct Costs Amount, Indirect Costs Amount, and Profit for each job, phase, category, and class.

-

Organize jobs through the structuring of phases set up independently for each job. Default phase sets can be used for any job for which a specific set of phases has not been pre-established. Each job set can have its own structure of phases.